This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

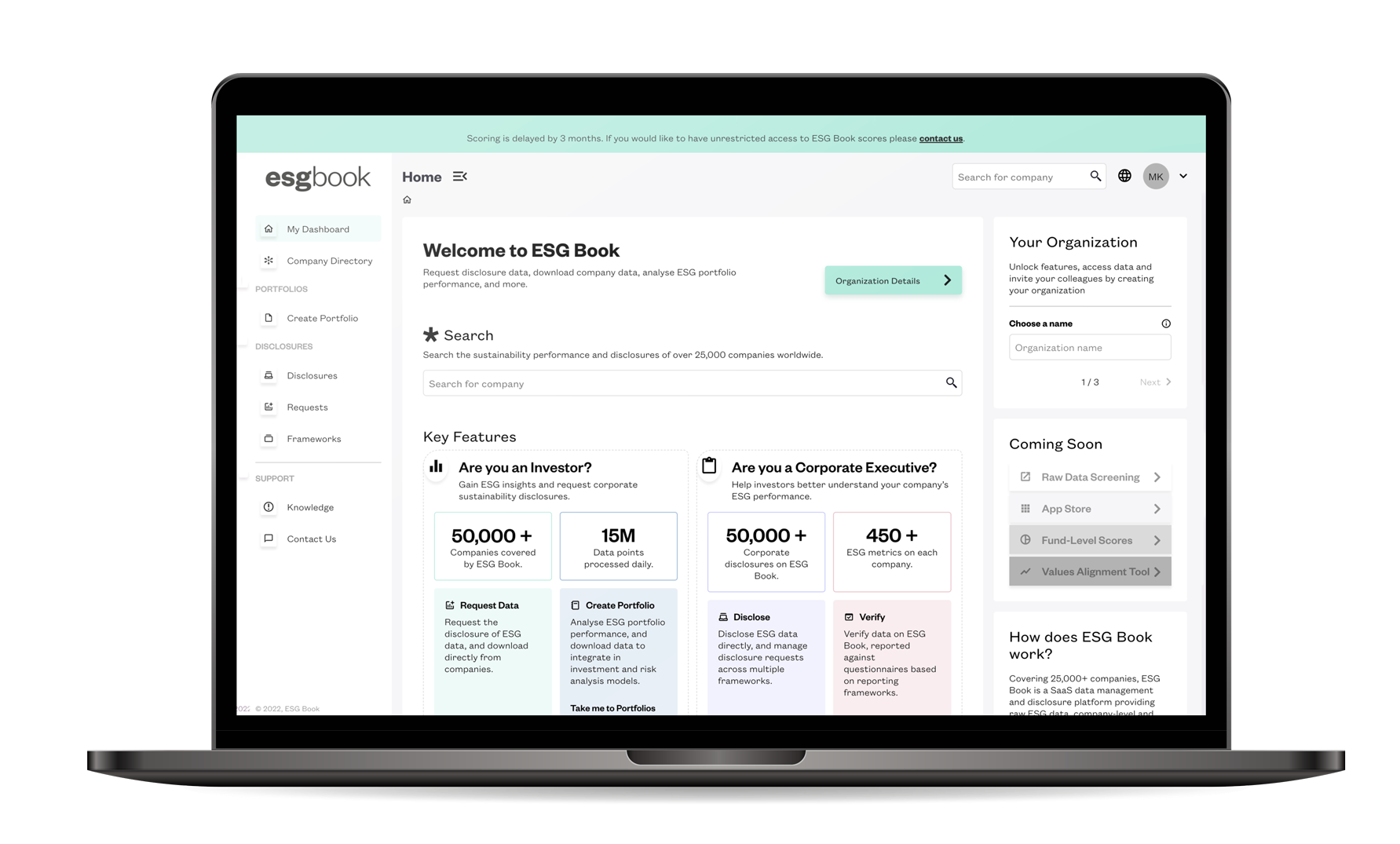

Welcome to ESG Book. Powering financial markets to deliver a sustainable future.

The future of ESG

Sustainability is transforming financial markets at an unprecedented rate. However, this transition will fail without better data.

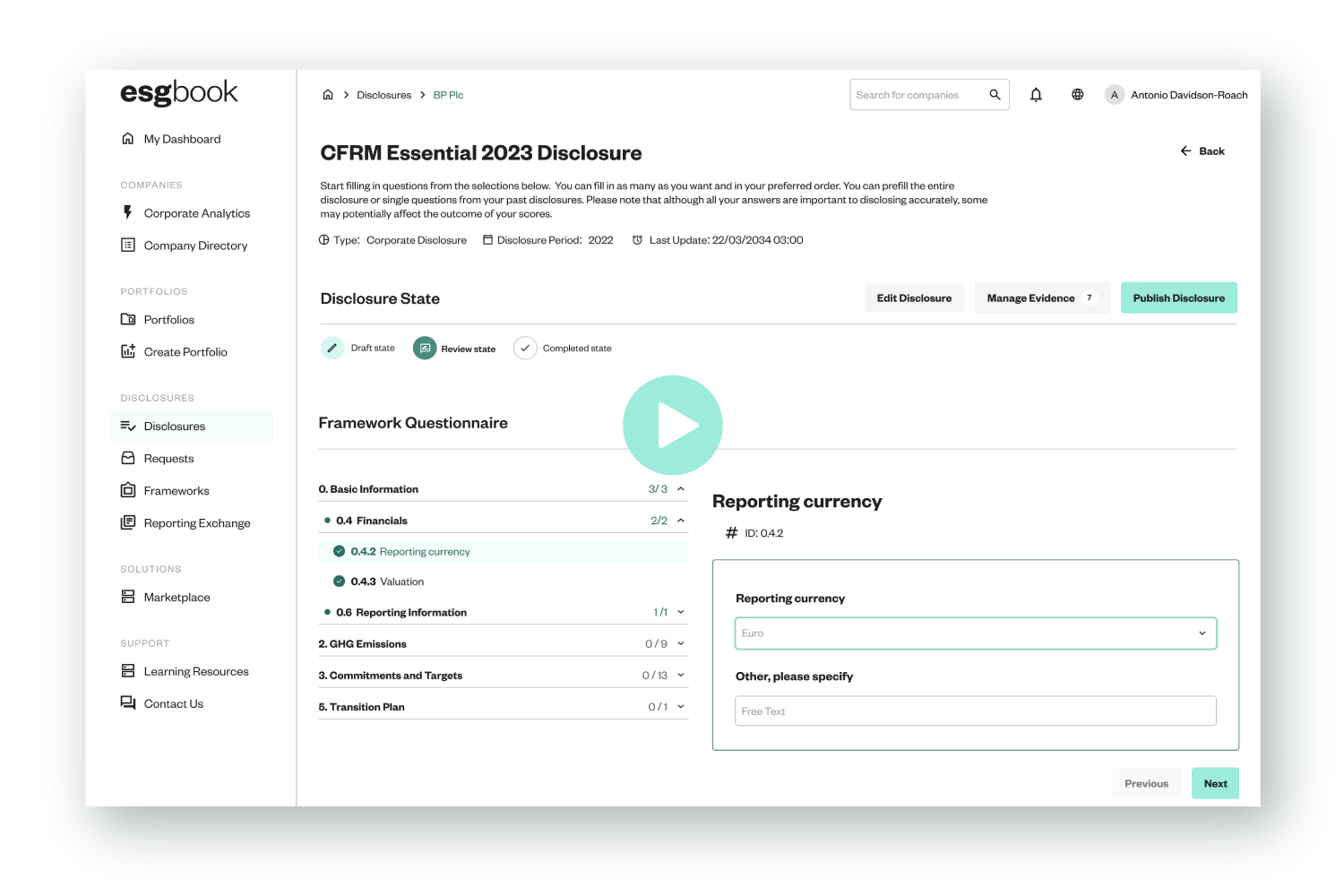

ESG Book combines cutting edge technology and proprietary research to fix a fundamental problem; markets need clearer ESG information to allocate finance efficiently to more sustainable outcomes.

Our solutions make sustainability data more widely available and comparable for all market stakeholders. We enable companies to be custodians of their own data, provide framework-neutral ESG information in real-time, and promote transparency through our digital platform.

Watch: Introducing Our Team

Watch: Introducing Our Team

Watch: Sanda Ojiambo,

CEO &

Executive

Director, UN Global Compact

Watch: Sanda Ojiambo,

CEO &

Executive

Director, UN Global Compact

Watch: Emmanuel Nyirinkindi,

Vice President for Climate & Cross-Cutting Solutions, IFC

Watch: Emmanuel Nyirinkindi,

Vice President for Climate & Cross-Cutting Solutions, IFC

Watch: Dr Daniel Klier, CEO ESG Book, introduces

ESG Book

Watch: Dr Daniel Klier, CEO ESG Book, introduces

ESG Book