By Luisa Jung

INSIGHTS Research

In this blog, our summer intern, Luisa Jung provides a high-level introduction on how we incorporate AI into the construction of investment portfolios on our technology platform, AutoCIO, which delivers active, customisable investment strategies at the click of a button.

Having grown up with technology for as long as I can remember, Artificial Intelligence (AI) has always been an abstract and, admittedly, quite intimidating concept for me. However, my confusion around AI disappeared within my first few weeks at Arabesque. I spoke with the Researchers and Engineers on the AI team and soon had my ‘lightbulb moment’ when I realised that it was the obvious next step for the AI industry to apply itself to financial markets given their incredibly complex and interconnected nature.

Our web application, AutoCIO, enables clients to create active, hyper-customised, and sustainable investment strategies by choosing from hundreds of user-defined parameters, making it an extremely scalable and cost-effective process towards creating strategies. As you read this blog post, I hope to demystify our use of AI in the strategy construction process and contribute to your understanding of AutoCIO.

What is the AI Engine?

AutoCIO is powered by our AI Engine, which analyses fundamental behaviours and structures of financial market and evaluates over 25,000 stocks daily with an expectation of expected return. This creates a data foundation that enables the potential output of millions of investment strategies. At its core, the AI Engine consists of an ensemble of machine learning models that analyse a vast amount of financial and non-financial data to distinguish how this information may impact the future return of an asset. (Please read the dedicated blog post from September 2021 to obtain a more detailed explanation.)

Figure 1: AI Engine Input Dataset examples

Portfolio Creation with AutoCIO

Reducing management fees to stay competitive, whilst addressing changing client needs is a major challenge for the asset management industry. To combat the challenges the industry faces, we embrace the application of AI in the portfolio construction process. AutoCIO has the capability of creating traditional, active investment strategies at an enormous scale, making the product agile to the needs of portfolio managers. Millions of potential investment strategies can be simulated in less than two hours for a fraction of the normal research cost. The AI Engine ensures that AutoCIO is continuously adapting to new market trends and behaviours.

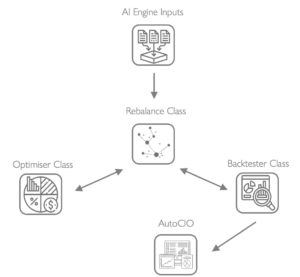

Let’s now look at how AutoCIO works: once the AI Engine has analysed the big data input and calculated an expectation of stock return for all the 25,000+ assets, AutoCIO then implements the portfolio construction process. This process consists of three interlinked classes:¹ Rebalance, Optimiser and Backtester.

Figure 2: AutoCIO Strategy Construction

Rebalance

AutoCIO portfolio construction begins with the Rebalance class, which is essentially the creation of an investible universe – a group of stocks that are considered investible, meaning that they would potentially satisfy a minimal set of conditions or criteria such as liquidity, size etc. How do we create a universe? First, market filters are applied:² Besides selecting the geography (i.e. adding or removing individual countries to be a part of the strategic universe), we can include/exclude certain sectors or industries.

Now that we have created the skeleton of the strategy, we can apply additional filters to further define the universe of stocks. For example, we could filter on liquidity, define the exposure of the strategy by setting the market cap, and/or filter on stock activity. Lastly, we may exclude certain stocks by implementing certain ESG or other style preferences.

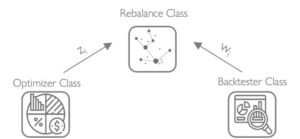

By selecting these filters, the included stocks can then be further optimised in subsequent steps. Besides constructing the strategic universe, the rebalance class acts as interface, or a sort of ‘middleman’, between the Optimiser and the Backtester classes, cleaning the data it receives from both sides.

Optimiser

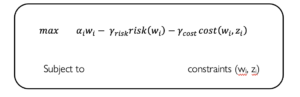

Within the Optimiser class, we decide on the most optimal portfolio within the investible universe at each rebalancing. The objective of the Optimiser class is to choose a portfolio of stocks that maximises a function which considers returns, transaction costs, and an investor’s risk-profile subject to a number of constraints. The first component of the function is the portfolio’s alpha assessment – determined by the AI Engine. The second and third components are portfolio risk and cost appetite, respectively. Risk in AutoCIO is calculated as portfolio variance. For costs, a combination of parameters including trading commission, bid-ask spread, and market impact costs are considered. The coefficients of the equation for risk and cost aversion are negative to reflect that they detract from the alpha component of the portfolio being maximised. The weights for all the stocks in the portfolio (referred to as wi in the equation) correspond with the forecasted alpha, risk and cost components of the function.

Lastly, the Optimiser implements constraints; for example, we may implement a strategy constraint, like long-only (wi ≥ 0), or a risk constraint like maximum position size (wi ≤ max. position size). The magnitude of the coefficients for each of the terms within the function, as well as the accompanying constraints are fully customizable to ensure that each investors objective is being met.

The following equation explains the goal of the Optimiser:

Backtester

Once the strategy has been constructed, the Backtester simulates the trades. The Backtester is a historical simulation that replicates how the strategy would have performed historically. AutoCIO can run a wide array of strategies at different frequencies in different regions and markets. Once the backtesting is complete, the strategy is available for clients via the AutoCIO web application. In addition to the client’s customised portfolio strategy, the user interface also offers the possibility to view AutoCIO’s off-the-shelf strategies. The web application allows clients to analyse a strategy using statistics and factor attribution.

Wrapping Up

I hope this blog post has made it clear that AI can be a solution to three key challenges faced by the asset management industry: customisation, cost, and performance. AI enables and facilitates the customisation process by quickly implementing preferences, reducing effort and time. This leads us to the next challenge which AutoCIO solves – cost. Traditional, active investment strategies are normally cost intensive, as they require an ‘army’ of analysts to conduct significant research and due diligence. AutoCIO allows investors to bypass these lengthy and costly processes. Lastly, performance is accounted for by our AI Engine which utilises a vast array of data and the latest advancements in machine learning research to find return opportunities in markets. As our research and the review of our created strategies have shown, strategies created on AutoCIO generally outperform their respective benchmark over 80% of the time and with less volatility.³

AutoCIO provides an opportunity for institutional investors to generate funds at scale with the computational power to analyse high volumes of financial and non-financial data to service a growing demand for customisation and values-based strategies. It’s no longer a case of ‘if’ or ‘when’ AI will enter investment functions. The opportunity for autonomous investing is here now.

Here are some key takeaways about AutoCIO:

- Arabesque’s AI Engine produces an expected return assessment for over 25,000 stocks on a daily basis.

- Rebalancing allows AutoCIO to consider a large range of preferences and exclusion criteria to construct an eligible universe of stocks.

- The Optimiser, based on the AI Engine outputs received, optimises the portfolio from the rebalanced universe to achieve a client’s investment objective.

- The Backtester simulates the trades and runs a historic simulation and shows how the stocks would have performed historically.

- The use of AI in asset management allows for a more comprehensive analysis of investment strategies and is more agile to consumer/market demands.

¹ In coding, many languages use the concept of objects and classes. Objects are a construct enclosing data and functions. Classes provide the structure for building these objects.

² Instead of selecting from a range of optional filters, it is also possible to select a particular predefined benchmark.

³ 1,200 funds generated by autonomous asset management platform AutoCIO delivered an average of 1.86 percentage points (pp) in excess returns and a 2.89pp reduction in volatility compared with equivalent benchmarks over a ten-year period. 87% of these portfolios outperformed their benchmarks. This effect while stronger in some regions, holds across all regions.