The United Nations Global Compact (UN GC) is “the world’s largest corporate sustainability, voluntary, initiative that seeks to advance universal principles on human rights, labour rights, environment and anti-corruption through the active engagement of the corporate community.”

INSIGHTS Research

“We have to choose between a global market driven only by calculations of short-term profit, and one which has a human face”.[1]

Kofi Annan

The United Nations Global Compact (UN GC) is “the world’s largest corporate sustainability, voluntary, initiative that seeks to advance universal principles on human rights, labour rights, environment and anti-corruption through the active engagement of the corporate community.”[2]

The UN GC is based on CEO commitments to implement those universal sustainability principles and to take steps to support UN goals.

Background

In 1999, UN Secretary-General Kofi Annan delivered a speech in Davos, Switzerland, to the World Economic Forum. He addressed the widening gap between fast-paced global markets and political and social systems, urging the private and public sector to unite in order to combat growing imbalances. This “speech act”, a call to action, inspired businesses and institutions to come together under a global compact of shared values, resulting in the world’s largest corporate sustainability initiative that has grown to over 12,000 signatories in more than 160 countries.

Georg Kell, the Founding Executive Director of the UN GC, and now Chairman of Arabesque, was tasked with establishing the Global Compact as the foremost platform for the development, implementation, and disclosure of responsible and sustainable corporate policies and practices.

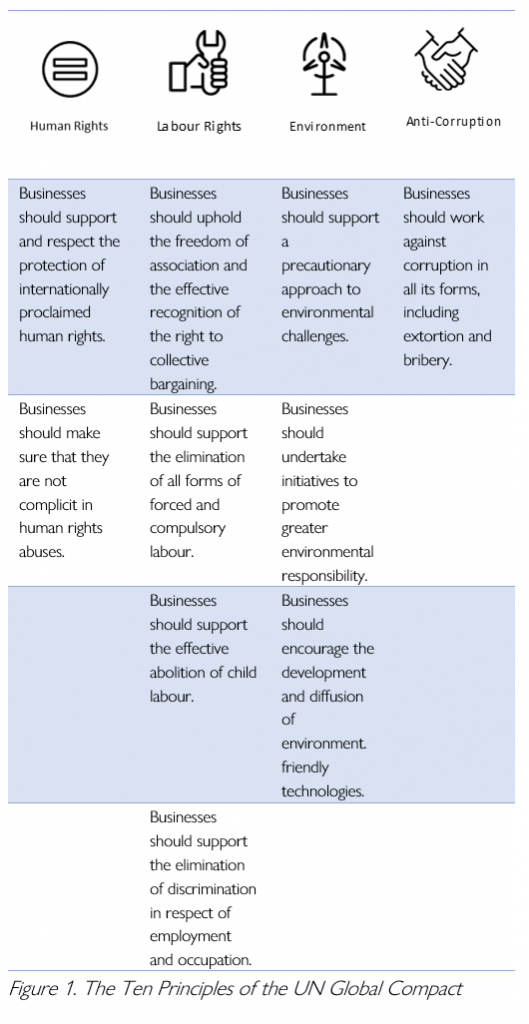

At the core of the UN Global Compact, there are ten universal principles grouped into four overarching themes (Figure 1.) Following on the UNGC’s steps, in early 2005, Kofi Annan invited a group of the world’s largest institutional investors to join a process to develop the Principles for Responsible Investment. The Principles were launched in April 2006 at the New York Stock Exchange. The UN PRI initiative aims to bring investors together to encourage incorporation of sustainability metrics into investment practice.

Rationale

From an investor’s perspective, incorporating UNGC’s principles enables us to:

- Ensure alignment with basic normative principles promoting responsible corporate behaviour, and

- Avoid financial risks related to reputational exposures.

Companies that purposefully / knowingly operate in a damaging manner to the environment, exploit or treat their employees poorly, or conduct business in an unethical manner are more prone to corporate scandals that can put their licence to operate at risk. Related lawsuits impact cash flows; negative press impacts brand value and consequently revenues, and rebuilding reputation and trust requires time.

For these reasons, companies’ alignment with the UNGC’s principles does not only make sense from an ethical perspective, but also from a financial standpoint.

Evidence

Below are several case studies that illustrate how companies not aligned with the UNGC’s principles suffered reputational repercussions that ultimately impacted their financial performance. For example:

- American utility provider PG&E was linked to destructive fires in California in 2015 and 2018 due to negligent infrastructure maintenance or negligent maintenance of infrastructure. Following a lawsuit in January 2019, the company’s share price fell by almost 75%. Later that month, PG&E filed for bankruptcy.

- In 2018, Nissan’s CEO Carlos Ghosn was arrested for financial misconduct, which embroiled the company in a turmoil of negative press. The scandal eroded Nissan’s brand value and resulted in a 7% drop in its share price.

- Between 2015 and 2017, Valeant Pharmaceutical’s price plummeted by more than 90% as a result of questionable accounting practices, poor governance and a sharp increase in drug prices that hurt end customers. Following an investigation by the SEC, the company replaced previous management and rebranded to Bausch Health.

- Reckless conduct and gross negligence by BP in the operation of its oil towers led to one of the largest environmental disasters ever. The Deepwater Horizon oil spill resulted in millions of barrels being spilled into the Gulf of Mexico, causing extensive damage to marine and wildlife habitats. BP had to pay several penalties, which, together with the clean-up operation, cost BP $53.8 billion.

Implementation

Incorporating the principles of the UNGC in our investment process is at the heart of Arabesque’s investment philosophy. UNGC principles are considered in the construction of the eligible universe. In order to assess the likelihood of a company being in violation of the principles, Arabesque S-Ray, Arabesque’s sustainability research arm, has developed a unique a proprietary S-Ray® GC Score, which aims to measure how closely a company’s activities conform to the UN GC Principles. It converts qualitative information into numerical outputs so that all companies can be universally compared, regardless of sector or geography. At this stage, those companies that are more likely to be in violation of any of the UNGC principles are removed. It is not a requirement for companies to be UNGC signatories. What we are keen on understanding is whether a company’s behaviour is in line with the principles.

By incorporating the S-Ray® GC Score into the screening process, we improve the overall quality of the investment universe. Consequently, by lowering the chances of picking a “bad apple” in the portfolio, the portfolio tends to exhibit improved risk-adjusted returns and lower tail risks.

References

- Kofi Annan’s address to World Economic Forum in Davos (link)

- United Nations Global Compact (link)

- Financial Times, Nissan cuts last remaining ties with Carlos Ghosn, 2019 (link)

- The Wall Street Journal, PG&E Losses Widen as Fire Costs Rise, 2019 (link)

- Business Insider, Valeant’s collapse – from Clinton’s tweet to Ackman’s exit, 2017(link)