A sustainable company is one that is managed in such a way that is positioned for long term financial success while accounting for all stakeholders’ interests. ESG data are the means that can enable an investor to quantify a company’s strategy, corporate purpose and management quality. Unlike SRI, which is based on ethical and moral criteria and uses mostly negative screens, or impact investing which targets specific social/environmental outcomes, ESG analysis is based on the assumption that ESG factors have financial relevance.

INSIGHTS Research

In recent years, a growing number of investors have begun to incorporate ESG factors into their traditional investment processes, based on the underlying thesis that ESG factors can have a material impact on financial risk and return.

Background

The term ESG was first introduced in a UN study “Who Cares Wins” in 2004. The report was the outcome of an initiative by former UN Secretary General Kofi Annan when in early 2004 he wrote to over 50 CEOs of major financial institutions, inviting them to participate in a joint initiative under the auspices of the UN Global Compact with the goal to align business incentives with society’s wider interests. This report was one of the primary drivers of the formation of the Principles for Responsible Investment (PRI) at the New York Stock Exchange in 2006.

The origins of modern ESG investing date back to the early 1970s, when investors began to engage with and divest from companies whose business practices were not in line with their ethical, religious, or political values. Under the acronym of SRI (Socially Responsible Investing), this approach expanded over time to encompass inclusion (or exclusion) based approaches that set extra-financial considerations alongside financial considerations. In recent years, a growing number of investors have begun to incorporate ESG factors into their traditional investment processes, based on the underlying thesis that ESG factors can have a material impact on financial risk and return. Consequently, sustainable investing has evolved from its early focus on restricting investments and divestiture to one that also incorporates sustainability considerations as a positive input when evaluating the underlying value, risk and return potential of companies.

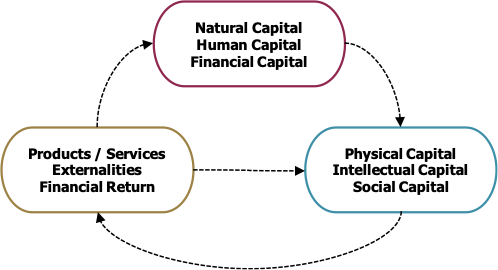

Figure 1 The Value Creation Process, Source: Integrated Governance: A New Model of Governance for Sustainability

Rationale

Financial information indicates how financially successful a company had been in the past. However, as per every disclaimer in financial reports, “past performance is not an indicator of future results”. Whether a company will be financially successful in the future is a function of its corporate strategy and the management’s ability/quality to execute it. As such, incorporating non-financial information in the equity research extends the traditional financial analysis to a holistic business analysis.

From the Value Creation Process framework (Figure 1.), we understand that a company’s competitiveness depends on preserving and enhancing the different types of resources and capabilities that it uses to deliver products and services. How a company behaves towards the different capitals it is leveraging will determine the direction and impact of its externalities.

Evidence

Academic findings have had a significant impact to the increased focus that ESG investing has received over the past years. Stocks of companies with superior environmental practices have been found to be less volatile than the broad market, while fixed income markets have rewarded environmentally-aware issuers by permitting them to carry greater leverage relative to peers (Sharfman, et al 2008). Companies deemed more socially responsible have been found to exhibit lower idiosyncratic risk (Lee et al 2009.). Conversely, those perceived as less socially aware appear to be more likely to experience financial distress (Goss, Allen. 2009).

In a nutshell, academic literature suggests that good ESG performance is linked to less market volatility, lower risk, and better financial performance. A meta-study published in 2015 by the University of Oxford and Arabesque titled “From the Stockholder to the Stakeholder” summarized approx. 200 scientific sources on the economic effects of sustainability and found that good ESG performance is linked to better stock price performance (80% of the studies), better operational performance (88% of the studies), and lower cost of capital (90% of the studies).

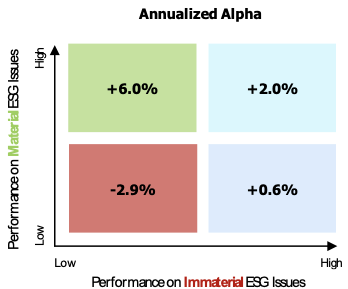

Figure 2: Khan, M., Serafeim, G. & Yoon, A., 2015

Building further on the ESG-financial performance link, Khan, Serafeim, and Yoon in their paper “Corporate Sustainability: First Evidence on Materiality” showed that companies’ sustainability efforts should be focused on sector specific material topics in order to be translated to financial benefits. In other words, the authors find that firms with good ratings on immaterial sustainability issues do not significantly outperform firms with poor ratings on the same issues. In contrast, firms with good ratings on material sustainability issues significantly outperform firms with poor ratings on these issues. (Figure 2.)

Implementation

In our investment process, we use the S-Ray® ESG Score to remove companies ranking at the bottom of their sector, during the universe creation phase. Additionally, we include companies that exhibit a positive ESG score momentum, based on the idea that ESG improvements might not have been reflected in the companies’ price and may add alpha. We have found that the integration of sustainability considerations contributes to absolute and relative performance for our portfolios, while minimizing volatility and drawdowns. At the same time, by avoiding allocating capital to companies that perform poorly on sustainability topics we support long-term thinking and promote positive societal and environmental impact.

References

K Clark, G. G, Feiner A., Viehs, M., From the Stockholder to the Stakeholder, 2015 (link)

Goss, A., Corporate Social Responsibility and Financial Distress, 2009 (link)

Khan, M., Serafeim, G., Yoon, A., Corporate Sustainability: First Evidence on Materiality, 2016 (link)

Lee, D. D., Faff, R. W., Corporate Sustainability Performance and Idiosyncratic Risk: A Global Perspective, 2009 (link)

Sharfman, M. P., Fernando, C. S. Environmental risk management and the cost of capital, 2008 (link)